State tax return calculator

In most states interest on out-of-state municipals is subject to state income tax and applicable local income tax. If a sales tax rate of less than 625 is paid to the other state the Massachusetts use tax is the difference between the 2.

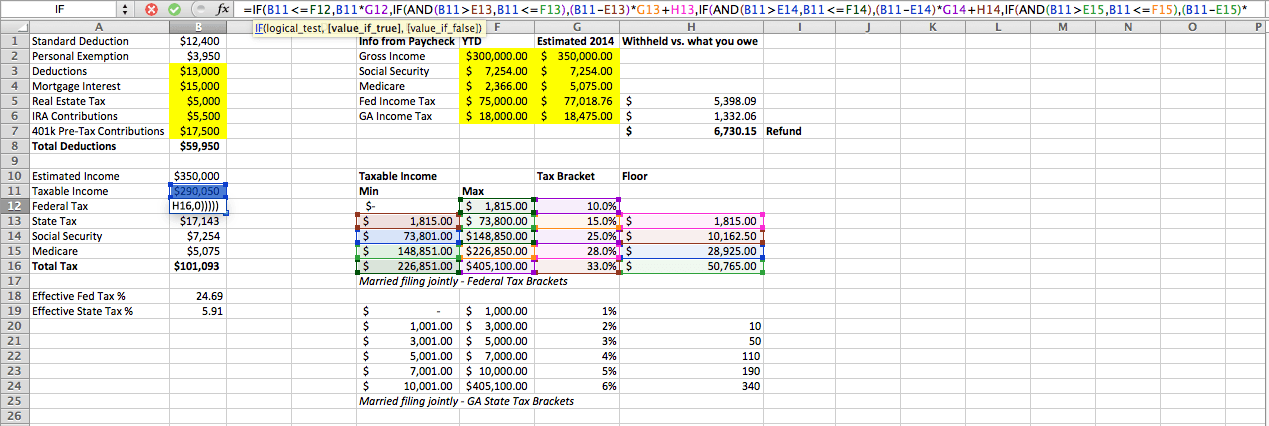

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

If you pay taxes on your personal property and real estate that you own you payments may be deductible from your federal income tax bill.

. Who purchase and use HR Block desktop software solutions to prepare and successfully file their 2021 individual income tax return federal or state. It does not provide. Once you input all the information for your situation youll receive details about your results and instructions on how to update your state income tax withholding using the new Oregon Form OR-W-4.

State and local property taxes up to 10000 can be deducted in addition to income taxes or sales taxes. A tax return calculator takes all this into account to show you whether you can expect a refund or not and give you an estimate of how much to expect. Most state and local tax authorities calculate property taxes based on the value of the homes located within their areas and some agencies also tax personal property.

Check e-file status refund tracker. Therefore you wont pay the same tax rate on the entire amount. Tax Deductions and Tax Credits Explained Remember that a tax deduction reduces your taxable income cutting your tax bill indirectly by reducing the income thats subject to a marginal tax rate.

Youll probably have to file a part-year return instead of a nonresident return if you moved to another state during the year so you have income from two states. If you pay either type of property tax claiming. Its never been easier to calculate how much you may get back or owe with our tax estimator tool.

But some states offer exceptions from this rule and the federal government wont let. If the return is not complete by 531 a 99 fee for federal and 45 per state return will be applied. Start a New 2021 Tax Return.

Decreases the Medical Tax Deduction Rate. Below is a state income tax navigation chart that allows you to easily pick the right route to either. Homeowners in Nevada are protected from steep increases in property tax bills by Nevadas property tax abatement law which limits annual increases in property tax bills to a maximum of 3 for homeowners.

As you make progress the taxes you owe or the refund you can expect to receive will be calculated and displayed on each page. The tax brackets are progressive which means portions of your winnings are taxed at different rates. Reduces the State and Local Tax Deduction.

Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan. If you met any of the criteria mentioned below then you will be required to file a tax return using ITR-2. Depending on the number of your winnings your federal tax rate could be as high as 37 percent as per the lottery tax calculation.

Offer valid for returns filed 512020 - 5312020. Calculate your total tax due using the tax calculator updated to include the 202223 tax brackets. The provided information does not constitute financial tax or legal advice.

TT reduces my 1040 line 10 amount because some of my 2008 state tax payment was made in 2009. Filing a State Tax Return or Tax Extension. Prepare ONLY one or more state income tax returns online and mail them to the states.

State and local tax rates vary by location. For DC and ND residents interest on out-of-state municipals is not subject to state income tax the benefit of which is shown. Compared to the 107 national average that rate is quite low.

It will rise back to 10 in 2019. This calculator computes federal income taxes state income taxes social security taxes medicare taxes self-employment tax capital gains tax and the net investment tax. The California State Tax Calculator.

Estimate the areas of your tax return where needed. What tax or pay information do I need to g et st arte d. Learn More About State Tax Returns State Extensions and State Amendments.

Taxpayers should keep their tax returns and supporting documents related to their tax returns for as long as their state tax agency and the Internal Revenue Service have to perform an audit. Prepare File 2021 State Returns Only. Your tip applies to my 2009 return because some of my 2008 state tax was refunded.

Our income tax calculator calculates your federal state and local taxes based on several key inputs. Enter your tax information to the best of your knowledge. Check the IRS Tax Return status of your 2021 Return.

The Medical Tax Deduction rate is decreased from 10 to 75 for 2017 and 2018 Tax Returns regardless of age. The income tax return form to be used by an individual depends on the sources of hisher income hisher residential status and assets held by himher. You can quickly estimate your California State Tax and Federal Tax by selecting the tax year your filing status Gross Income and Gross Expenses this is a great way to compare salaries in California and for quickly estimating your.

Each state gives credit to purchasers for sales tax paid to the other state. 202223 Tax Refund Calculator. HR Block does not provide audit attest or public accounting services and therefore is not registered with the board of accountancy of the State in which the tax professional prepares returns.

We strive to make the calculator perfectly accurate. Many states have a separate tax form for part-year filers but youll simply check a box on the regular resident return in others indicating that you didnt live in the state for the entire. This credit is only granted for sales tax paid to another state if that state has a reciprocal salesuse tax agreement with Massachusetts.

If You Moved During the Year. See Important IRS Federal Tax Day Deadlines and Due Dates and State Income Tax Day Deadlines and Due Dates. Your total deduction for state and local income sales and property taxes is limited to a combined total deduction of 10000 5000 if married filing separately.

Most notably capital gains. Your household income location filing status and number of personal exemptions. The Sales Tax Deduction Calculator helps you figure the amount of state and local general sales tax you can claim when you itemize deductions on Schedule A Forms 1040 or 1040-SR.

2 Federally tax-exempt obligations of states and their political subdivisions other than the taxpayers state of residence. You may prefer to use the State Tax calculator which is updated to include the State tax tables and rates for 202223 tax year. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location.

The calculator also works for pension i ncome withholding. To estimate your tax return for 202223 please select the 2022 tax year. Michigan Sales Tax Calculator You can use our Michigan Sales Tax Calculator to look up sales tax rates in Michigan by address zip code.

The states average effective property tax rate is just 053. Key IRS Tax Forms Schedules Publications. You might have to file a nonresident tax return if youve earned money in a state where you dont live as well as a resident tax return with your home state.

Salaried individuals use either ITR-1 or ITR-2 to file their income tax returns. Federal Income Tax Return Calculator. Find your states income tax rate see how it compares to others and see a list of states with no income tax.

If you used e-Collect and one the IRS and State agency have released your Refund money check the e-Collect Refund Status. Estimate your tax refund with HR Blocks free income tax calculator. These deadlines are known as statutes of limitationsFor most people this means keeping your tax records for at least three years from the date you file your tax return or the.

Prepare and eFile your state income tax returns.

How To Calculate Income Tax In Excel

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Income Tax Calculator Calculate Taxes For Fy 2022 23 2021 22

/dotdash_Final_Tax_Equivalent_Yield_Nov_2020-01-c528a1d54d4f48f19113104ac3291de1.jpg)

Tax Equivalent Yield Definition

Excel Formula Income Tax Bracket Calculation Exceljet

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

How To Calculate Income Tax In Excel

Tax Return Calculator How Much Will You Get Back In Taxes Tips

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

1120 Calculating Book Income Schedule M 1 And M 3 K1 M1 M3

Tax Calculator Estimate Your Income Tax For 2022 Free

How To Calculate Taxable Income H R Block

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

Tax Return Calc Hotsell 51 Off Ilikepinga Com

Tax Year 2022 Calculator Estimate Your Refund And Taxes

Federal Income Tax Calculator Find Your Irs Refund Payment For Your Return

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download